Many traders have working trading strategies, but they are limited by a lack of funds, and this is where funded futures accounts come in. Provided by proprietary trading firms, funded accounts are created to provide funds to qualified traders who have demonstrated their skills and trading abilities.

The traditional futures market requires a significant amount of capital to meet margin requirements needed to trade. Unfortunately, not many retail traders have access to those significant pools of capital on their own. This has caused hundreds of thousands to turn to prop trading accounts as a vehicle to earn bonuses and eventually have access to firm capital.

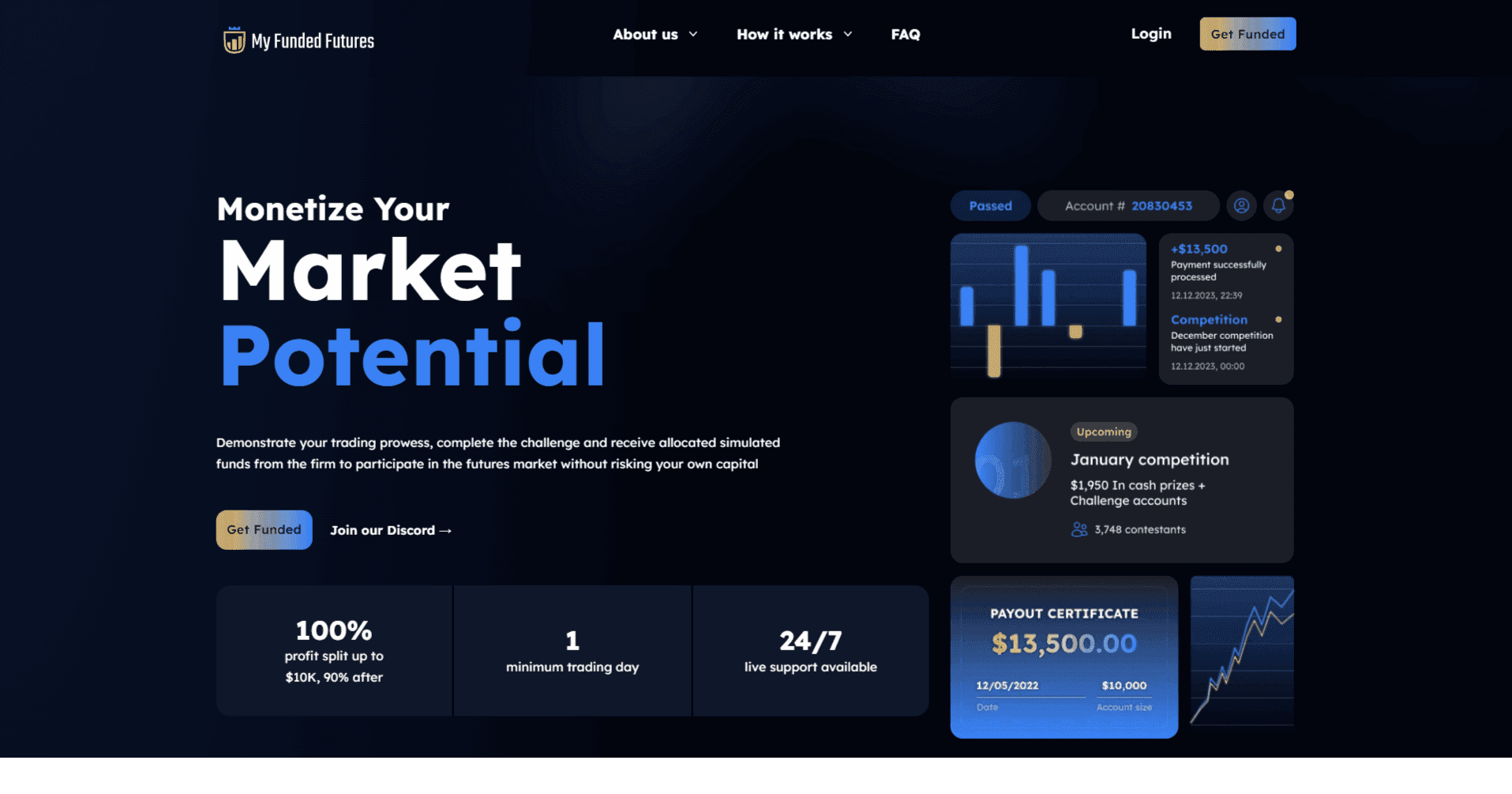

MyFundedFutures has grown to be a leading provider of funded futures accounts. The company has more than 150,000 community members from over 142 countries. Its user-friendly interface and community-focused features have made it a standout option for those who trade forex, futures, equities, and various financial instruments.

What is a Funded Futures Account?

Futures funded accounts are trading accounts provided by proprietary trading firms, where the trader does not trade with their own money---the firm provides all the capital to proven traders. The model also involves a profit-sharing mechanism, where the profits made are shared between the platform and the traders at a pre-agreed percentage, with the trader typically taking the larger portion.

This model has become increasingly popular among independent traders, especially those looking to scale without putting their own capital at risk. By removing the financial barrier to entry, funded futures accounts allow skilled traders to focus solely on performance and discipline. Traders are required to pass an evaluation or challenge phase---usually a simulated trading environment with specific profit targets and risk limits. Once successful, they gain access to a live account funded by the firm, giving them real exposure to the futures market without personal financial risk.

These accounts are commonly used to trade high-liquidity instruments such as the E-mini S&P 500 (ES), Micro E-mini (MES), or Nasdaq (NQ) futures. Funded accounts not only offer access to capital but also serve as a professional structure that encourages better risk management and consistency. Many firms also offer scaling plans that increase the size of the trading account based on performance, allowing traders to grow their earning potential over time. For experienced and emerging traders alike, funded accounts offer a direct path to trading professionally in the futures market.

The risk management model of prop firms is usually well-defined. The rules are there to help traders become more disciplined with their trade management style, which could assist them in becoming better traders. To obtain these accounts, futures traders typically go through an evaluation process that requires them to demonstrate their trading skills through one or two challenge structures.

Prop firms charge upfront fees for these evaluations, and they are typically designed to test the trader's ability to generate consistent profits, manage risk, and follow specific trading rules.

How Funded Futures Accounts Work

Here's a breakdown of [how a typical funded account works:

Evaluation Phase

This phase requires futures traders to prove they can trade properly by passing structured challenges. The traders will be required to pay an upfront fee to enter a challenge. The amount to be paid for the challenge is usually very minimal compared to the amount in the account they will receive.

Some platforms, like MyFundedFutures, even offer prices that are cheaper than the industry standard. For example, those using the 'starter' account pay as low as $97 per month for a $50,000 account.

During the evaluation phase, users are trading on a simulated (demo) account as they would on the live account. At this stage, they are usually required to reach a predetermined percentage profit, typically around 10%, but could be as low as 6% on MyFundedFutures.

This stage also tests traders' risk management strategies, as they must stay above the maximum drawdown limit to maintain the account. There are typically additional rules that must be followed, which may include minimum and maximum trading days, among others.

Depending on the prop firm, the evaluation phase can also occur in two stages (to include a verification stage), but the aim of both is to ensure that the proprietary trader can handle the prop account properly and get consistent results.

Funded Phase

After passing the evaluation stage, traders will have access to a simulated funded account, which gives them the opportunity to monetize simulated profit. When they begin to demonstrate consistency in their trades and profitability, they can obtain live capital from the prop firm.

Typically, traders can be funded up to $200,000 in one account, and they must continue to comply with the rules and meet specific performance metrics to maintain the account. The metrics include risk management strategies, drawdown thresholds, and not trading during certain market times.

Scaling Opportunities

Consistent traders can scale up their accounts over time. With this, they receive additional capital, which they can use to trade when they generate profits consistently and meet specific profit thresholds. Some firms offer direct scaling without requiring any further evaluations.

Scaling opportunities also allow prop traders to manage multiple funded accounts. This enables them to oversee several proprietary accounts simultaneously and potentially earn profits from all of them. MyFundedFutures, for example, offers up to 3 active accounts at the same time.

Profit Splits

At the point of withdrawal, the profit made by the trader is split between them and the prop firm. In most cases, the funded trader receives the higher profit percentage, for example, 80%, while the prop firm receives 20%. The payout structure can vary with different firms, as it may be biweekly or monthly.

MyFundedFutures also stands out in this area as it offers traders 100% of their profits up to a $10,000 withdrawal threshold, after which it will start charging only 10%, while traders still keep 90% of the funds made.

Benefits of Trading with a Futures Funded Account

There are various advantages to using a funded account. One of them is that prop traders do not use their own capital; this reduces financial pressure, which decreases the chances of emotional trading. It also shields their personal finances from the negative effects that market volatility could have on them.

Additionally, futures funded accounts provide traders with high buying power, as they gain access to significantly higher funds than most retail traders can afford with just a small fee. They can even earn more when they start to scale up their accounts.

Retail traders can trade with more discipline when using a prop firm, as they know they must maintain certain risk management rules. This could also help them improve their position sizing skills and trade with less risk. The skills acquired from these experiences could have a long-term impact on their trading careers.

Funded accounts allow traders to potentially make substantial profits without having to make significant upfront investments. They may create a path to professional trading for prop traders as they manage large funds that they do not own.

Why MyFundedFutures is the Best Choice for Futures Funded Accounts

Looking for the best futures funded prop accounts? MyFundedFutures stands out with simple and fair evaluation processes, offering various accounts to ensure that all traders, regardless of their experience level, enjoy the services and have equal chances.

The firm's profit split structure is better than what is available in the industry. Traders are offered 100% of the profit they make up to $10,000, and after that, MyFundedFutures only takes 10%.

The prop firm also provides transparent rules and fast payouts. Unlike many prop firms that have set payout days, starter plan users can withdraw after achieving 5 winning days with 40% consistency. Users are only required to have profits as low as $100 to $300 for each winning day, depending on their account size. Those using the expert plan have no withdrawal restrictions.

Additionally, there are various materials and educational resources to support traders and help them make the most of the platform. Customer support is consistently active every business day and is ready to answer questions and solve problems for users.

MyFundedFutures partners with other reputable firms, including TradingView, Volumetrica Trading, and NinjaTrader. There are also numerous positive reviews from satisfied clients testifying about the user-centric services.

A Funded Futures Account Could Elevate Your Trading Career

Funded futures accounts have been of immense benefits to retail traders who have been limited by funds. All they have to do is prove their trading skills, and they get funded with substantial amounts. This could be a game-changer for many forex, commodities, and other futures traders.

Ready to start trading with a funded futures account? Join MyFundedFutures today and get funded!

Ready to dive in?

Explore our challenge accounts, pick the one that fits you best, and start your journey to getting funded.

Explore AccountsThis material is provided for educational purposes only and should not be relied upon as trading, investment, tax, or legal advice. All participation in MyFundedFutures (MFFU) programs is conducted in a simulated environment only; no actual futures trading takes place. Performance in simulated accounts is not indicative of future results, and there is no guarantee of profits or success. Fewer than 1% of participants progress to a live-capital stage with an affiliated proprietary trading firm. Participation is at all times subject to the Simulated Trader Agreement and program rules.

Frequently Asked Questions

Rate this article

Related Posts

Read our most popular posts

Gold vs. Silver Futures: Key Differences and Which Should Beginner Traders Choose?

Precious metals are rallying on economic and geopolitical uncertainty; while futures offer leverage, gold’s stability and liquidity make it a safer starting point than silver for beginners.

Which Prop Firms Offer Daily Payouts and How Do They Work?

Daily payout prop firms let traders withdraw profits far more frequently than traditional models, sometimes even from the very first funded day. Instead of waiting weeks for a payout cycle, traders can request withdrawals every day, subject to rules on drawdown, buffers, and minimum amounts. This guide explains how daily payout structures work, which futures prop firms are known for fast withdrawals, what to watch out for in the fine print, and how MyFundedFutures’ Rapid plan fits into this newer payout landscape.

What Is MyFundedFutures Scale Account and Is It The Right Plan For You?

The MyFundedFutures Scale Account is a middle-tier evaluation plan that balances affordability with growth potential. The scale plan offers weekly payout opportunities with increasing withdrawal limits, no daily loss cap, and a clear path to live funding after just five consecutive payouts.